Battery Storage Availability: FlexGen BESS Site Uptimes Standout

With the ever-changing demand on the energy market, optimizing a battery storage site’s uptime is critical to stabilizing the grid and increasing the lifetime value of storage assets. Outages, planned and otherwise, happen. But without preventative measures, they could result in the loss of millions of dollars for asset owners and unpredictable rates for energy consumers.

A July 2024 report published by Orennia, a leading analytics platform in the energy industry, detailed 2023 battery energy storage system (BESS) outages in the ERCOT and CAISO markets. The report highlighted the economic implications of battery site availability and how FlexGen-supported BESS sites stand out in the industry.

Join Orennia to get report access and other insights

Differences in Battery Storage Availability

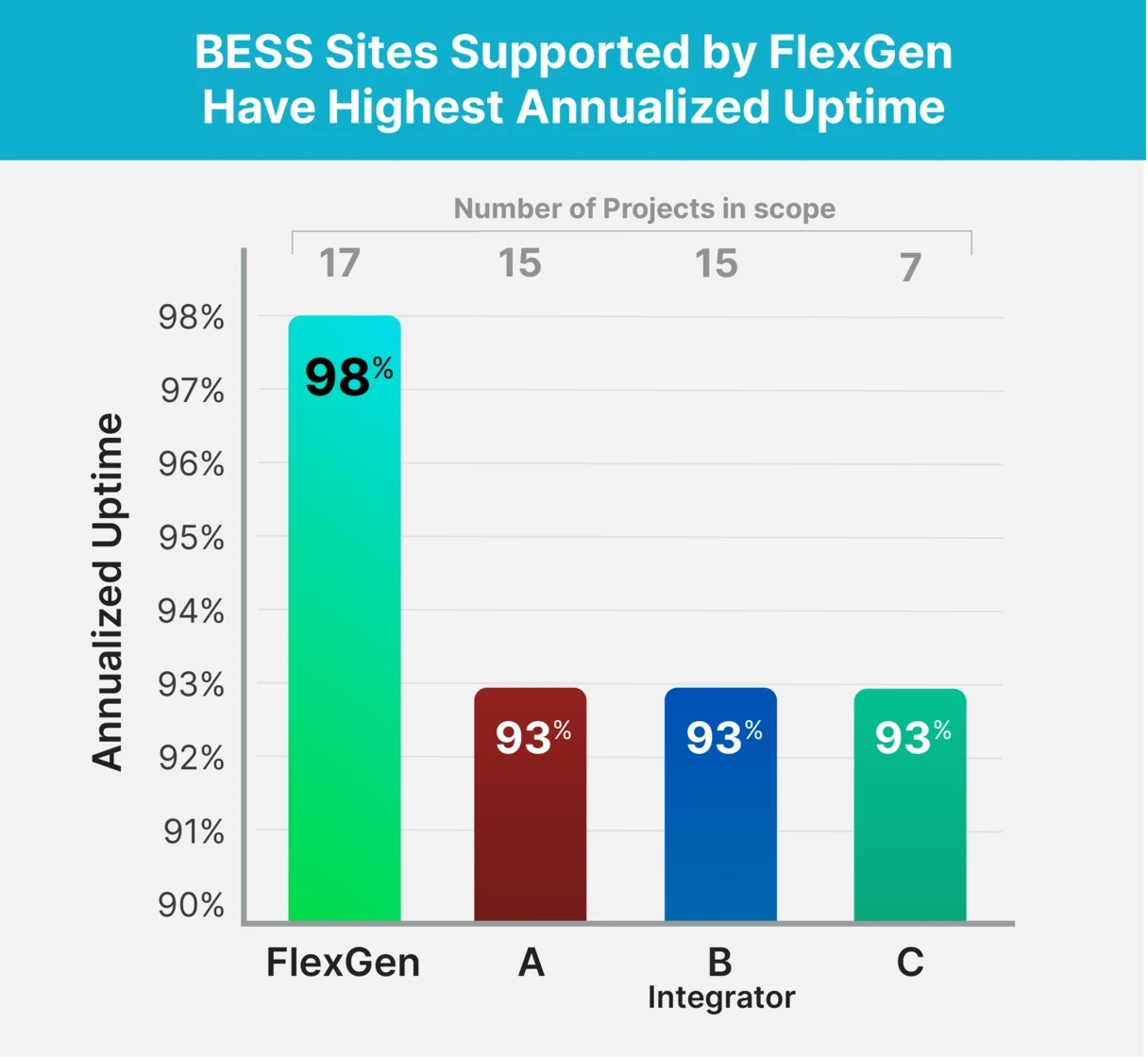

Advancements in the battery storage industry have significantly improved asset uptime in recent years, but availability remains a challenge. The annual availability of a battery is the percentage of hours the BESS is available to perform and is impacted by both unplanned and planned outages. The Orennia report, “Unplugged: Who was offline in 2023,” illustrated the relationship between annualized project outage rates and integrators, like FlexGen, who play a key role in optimizing BESS site performance.

The report highlighted FlexGen’s annualized outage rate of 2% last year, which is significantly lower than other integrators in the industry. The average outage rates for projects belonging to three of the other largest integrators were reported at around 7% for the same period. Depending on the energy trading strategy and the timing of significant power events, that 5% difference is significant.

Based on internal analysis using 2023 market rates as the baseline, the difference of 5% availability could be as high as $1.5M per year in ERCOT, $1.2M in CAISO, and $1.0M in PJM. A poorly timed outage of that 100MWh system throughout August 2023 would have an $11.6M impact in ERCOT, $2.2M in CAISO, and $1.2M in PJM.

Optimizing Battery Storage Availability

The value of energy storage systems is largely dependent on their uptime. Higher availability directly translates to more operational hours, ensuring that assets are consistently generating revenue and supporting the grid. An outage at a critical time, like during an extreme weather event, can result in significant missed revenue opportunities.

For example, a major energy storage owner operating in Texas had an outage rate under 15% last year. However, “due to most of its outages coinciding with high-earning revenue events, it missed over 60% of potential revenue in 2023, or $21 million,” according to the Orennia report.

How FlexGen Outperforms

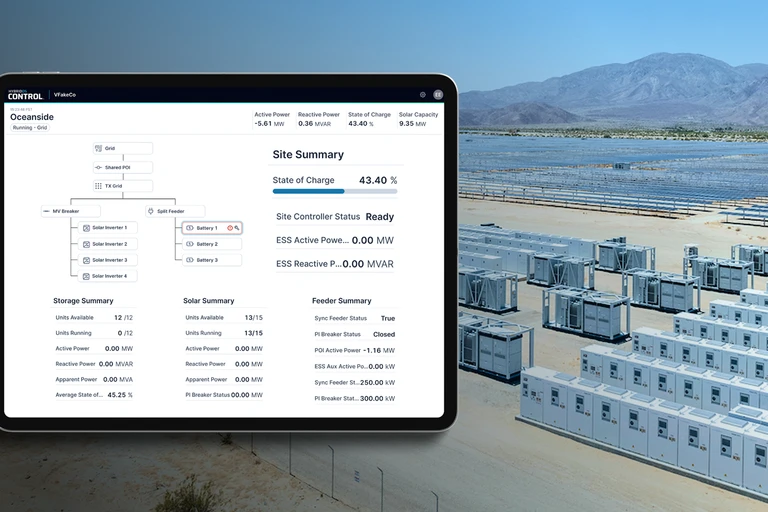

FlexGen’s performance shows that battery storage asset owners and operators do not need to accept these losses as the status quo. We position ourselves at the top of the energy storage market by pairing our comprehensive EMS and analytics software and services with the best hardware of the time. By being hardware agnostic and offering a variety of configurations, we deliver flexible solutions that outperform in any energy market.

Partnering with FlexGen on a BESS project improves performance by enhancing the ability to both maintain the system and quickly resolve any unexpected issues.

Want to learn more about how we optimize BESS site availability?

Get in touch with FlexGen here.